Chapter 2 – Strengthening the economy and the EU’s competitiveness

Introduction

In 2023, the European Union continued to focus on boosting competitiveness and making its economy green, digital, inclusive and resilient. With the Green Deal Industrial Plan, proposed in 2023, the EU aims to enhance the competitiveness of net-zero technologies and support the fast transition to climate neutrality. The EU also put forward a strategy for achieving economic security in the EU and set out key indicators for strengthening its long-term competitiveness.

Furthermore, it updated the sustainable finance framework and took steps towards reforming the customs union. 2023 also marked the 30th anniversary of the Single Market, and during the year the EU introduced a unitary patent system and measures to facilitate cross-border business. To ensure the EU economy benefits from digitalisation, the EU proposed a legal framework for a digital euro – which will complement the continued use of cash – and introduced a customs data hub. In addition, it submitted several legislative proposals that will bolster its capital markets union by making it safer for retail investors to invest; introduced legislation to counter the distortive effects of foreign subsidies on EU markets; and reformed and introduced frameworks to make banks more resilient during economic shocks.

Continued recovery and long-term resilience

Trends

In 2023, the EU economy continued to grow - open a new tab., albeit with reduced momentum due to the formidable economic shocks it had endured. Inflation eased throughout the year, thanks to declining energy prices and the moderation of inflationary pressure from food and industrial goods.

The EU economy is being supported by an exceptionally strong labour market, which has seen record low unemployment rates, the continued expansion of employment and rising wages. The implementation of reforms and investment under the Recovery and Resilience Facility - open a new tab. remains central to keeping the EU economy on the right track.

Looking ahead, Russia’s ongoing war of aggression against Ukraine and wider geopolitical tensions continue to pose risks to the EU economy’s growth prospects.

The success of the Recovery and Resilience Facility

In 2023, the implementation of the Recovery and Resilience Facility, at the heart of the €800 billion NextGenerationEU - open a new tab. recovery plan, continued to drive economic recovery - open a new tab.. The instrument bolstered the economic and social resilience of the Member States and supported REPowerEU, the EU’s initiative to help Member States accelerate their transition away from fossil fuels, in the light of Russia’s unprovoked invasion of Ukraine (see Chapter 4 for more on the REPowerEU initiative).

The facility is unique due to its performance-based nature. To benefit from it, a Member State must submit a recovery and resilience plan to the Commission. These plans outline the reforms and investments that Member States intend to complete by the end of 2026, for which they can receive financing up to a previously agreed allocation. The Commission disburses payments to Member States that are contingent upon the successful achievement of predetermined milestones and targets outlined in their plans. These measures are designed to tackle the Member States’ key challenges and align with EU objectives.

The Recovery and Resilience Facility is driving reforms and investment in six policy areas: (i) the green transition; (ii) the digital transformation; (iii) smart, sustainable and inclusive growth; (iv) social and territorial cohesion; (v) health, economic, social and institutional resilience; and (vi) policies for the next generation.

The EU also offers Member States help with implementing their recovery and resilience plans - open a new tab. via the Technical Support Instrument - open a new tab.. To date, more than 400 projects have benefited from this support. Twenty-three Member States have received or are currently receiving general support with the horizontal aspects of recovery and resilience plan implementation, including support in revising their plans, while all 27 Member States are benefiting from thematic support linked to the implementation of the Recovery and Resilience Facility measures.

A majority of people in Europe (53 %) think that NextGenerationEU can be effective in responding to current economic challenges.

Source: Standard Eurobarometer 100 - open a new tab., December 2023.

Thanks to the implementation of Member States’ recovery and resilience plans, by the end of 2022 (latest available figures):

Project examples

Green transition

In France, the RRF has financed energy-efficiency upgrades for 20 000 social dwellings and for student housing.

Social and territorial cohesion

The RRF is enabling Austria to help long-term-unemployed people gain access to training and qualifications.

Digital transformation

The RRF is boosting Italy’s cloud capacity by investing in data centres for the digital economy.

Health, economic, social and institutional resilience

An RRF-backed reform in Cyprus will enhance anti-corruption efforts and establish an independent anti-corruption authority.

Smart, sustainable and inclusive growth

The RRF has helped Spain assist more than 60 large companies and SMEs with sustainable mobility research and innovation.

Policies for the next generation

RRF funds have helped Czechia give around 74 000 digital devices to pupils for remote learning.

The EU budget: making the EU fit for current and future challenges

In 2023, the EU’s long-term budget (the multiannual financial framework) and NextGenerationEU were central to Europe’s recovery, addressing challenges such as the nearby war, high inflation, natural disasters and humanitarian crises. To ensure that the EU budget can continue to deliver on the most essential priorities, the Commission proposed a revision of the multiannual financial framework - open a new tab. in June.

In September, the EU’s annual budget for 2024 - open a new tab. was adopted. It addresses urgent crises in the Middle East and in Europe and its neighbourhood.

To support NextGenerationEU and aid Ukraine, the Commission raised around €116 billion in long-term funds in 2023, including up to €12.5 billion in green bonds, positioning the EU as a leading green bond issuer - open a new tab..

Building long-term resilience

During the year, the Commission presented its legislative proposals to implement the most comprehensive reform of the EU’s economic governance rules - open a new tab. since the aftermath of the 2007–2008 economic and financial crisis. The proposals stemmed from thorough reflection and extensive consultation. The new rules aim to facilitate and encourage Member States’ implementation of important reforms and investments. They will simplify economic governance, improve national ownership, place greater emphasis on the medium term and strengthen the enforcement of the EU’s fiscal rules, within a transparent common EU framework.

Croatia joins the euro area

On 1 January 2023, Croatia joined the euro - open a new tab. and the Schengen area.

The euro enhances convenience and competitiveness for Croatians, simplifying travel and trade. Its notes and coins symbolise the EU’s promise of freedom and opportunity for all Croatians.

A survey conducted in Croatia after the euro fully replaced the kuna shows that 61 % of Croatian citizens believe the changeover happened smoothly and efficiently, while 88 % felt they were well informed about the single currency.

In the EU, support for the euro continues to be very strong: 71 % of people in the EU support European economic and monetary union with one single currency, with the percentage standing at 79 % in the euro area.

Sources: Flash Eurobarometer 518 - open a new tab., February 2023; Standard Eurobarometer 100 - open a new tab., December 2023.

A cohesive European Union

2023 marked the 30th anniversary of the creation of the Cohesion Fund - open a new tab.. During its three decades of existence, the Cohesion Fund has invested nearly €179 billion in the economic, social and territorial cohesion of the EU. Cohesion-policy funding for the 2021–2027 period - open a new tab. is expected to increase the EU’s gross domestic product by 0.5 % and support the creation of 1.3 million jobs. Major projects completed or launched in 2023 include the restoration of the Pompeii complex, a new metro system for Thessaloniki and improved wastewater infrastructure in Romania. By the end of the year, cohesion-policy programmes for the 2014–2020 period had achieved significant results on the ground, including support for 4.5 million businesses, the creation of over 370 000 new jobs, improved broadband access for more than 7.9 million households and the installation of over 6 000 megawatts of additional capacity for renewable energy production.

These achievements underscore the vital role of regional and local public administrations, which are closest to the people and play a key role in delivering policy priorities and implementing EU legislation on the ground. In recognition of this, the ComPAct - open a new tab. initiative, launched in 2023, aims to enhance public administrations in the Member States.

A strong and resilient Single Market

30 years of the Single Market

In 2023, the EU celebrated the 30th anniversary of its Single Market - open a new tab., the establishment of which, on 1 January 1993, was a significant milestone in European integration. The Single Market is more than just a legal framework or a market; it represents an area of freedom, progress, opportunity, growth, shared prosperity, cohesion and resilience. This significantly strengthens the EU’s global economic and geopolitical position. Accounting for 15 % of global gross domestic product, it is the world’s largest integrated single market area, while remaining one of the most outward-oriented.

For over 30 years - open a new tab., the Single Market has been central to the EU’s competitiveness, improving the lives of citizens and making business easier. By increasing the EU’s gross domestic product by 9 %, it has delivered substantial economic benefits, bolstered by cohesion-policy support that enables all regions to engage with and benefit from it. The Single Market also plays a key role in facilitating the green and digital transitions. As the source of the EU’s regulatory, financial and supply-chain integration, it helps build economies of scale that are instrumental in helping businesses grow.

The Single Market in a nutshell

The Single Market accounts for 18 % of global gross domestic product …

… offering goods and services to more than 450 million people.

Source: ‘Annual Single Market Report - open a new tab.’, January 2023.

It covers:

23 million businesses …

… employing nearly 128 million people

€965 billion of intra-EU exports in services

€3 428 billion of intra-EU exports in goods

€8 163 billion of intra-EU investments

Did you know? (*)

47.5 % of EU exports of goods to non-EU countries in 2020 were in euro.

Over 60 % of foreign-controlled enterprises in the EU are controlled by a company in another EU Member State.

Between 2010 and 2021, the number of people employed in Member States who had citizenship of another Member State increased by 47.0 %.

2.4 % of tertiary-level students in Member States are from another Member State.

(*) Data refer to the EU with 27 Member States and the latest year available.

Source: Eurostat - open a new tab..

The Single Market has been crucial to the EU’s economic resilience, proving vital in recent crises such as the pandemic, or Russia’s actions in Ukraine and the subsequent energy crisis. Moreover, it serves as an important geopolitical tool, enhancing the EU’s influence amid geopolitical shifts and the race for clean technology. Despite its achievements, the Single Market must evolve in the face of new and changing geopolitical realities, technological advances and the green and digital transitions, and to boost the EU’s long-term competitiveness and productivity.

A stronger Single Market

The EU is continually improving the business environment across all sectors of its economy. In September 2023, the Commission presented a proposal to combat late payments - open a new tab. by companies and public authorities, a practice that compromises the cash flow of small and medium-sized enterprises (SMEs) and hampers the competitiveness and resilience of supply chains. This proposal is part of a broader series of measures in the relief package the Commission has introduced to support SMEs facing economic challenges.

The EU is also supporting innovation by making it easier for businesses to protect their intellectual property across the EU. The launch of the Unitary Patent - open a new tab. system in June was a significant step towards completing the Single Market and enhancing patent protection in Europe. This system provides a one-stop shop for the registration and enforcement of patents in Europe, leading to lower costs, less paperwork and a reduced administrative burden for innovators, and will benefit SMEs in particular.

In addition, the new Unified Patent Court - open a new tab., with jurisdiction over both Unitary Patents and existing European patents, will allow companies to enforce their patent rights more effectively. Additionally, the SME Fund - open a new tab., a joint initiative of the Commission and the European Union Intellectual Property Office - open a new tab., provides financial support (intellectual-property vouchers) to SMEs to manage their intellectual-property portfolios, including trademarks, designs, patents and plant varieties.

The Commission proposed a patent package - open a new tab. in April 2023, which complements the Unitary Patent scheme. Once adopted, businesses will benefit from a new, more balanced framework - open a new tab. for standard essential patents and simpler access to supplementary protection certificates for pharmaceutical and plant protection products, along with clearer rules on compulsory licensing during crises. In addition, the Regulation on Geographical Indications for Craft and Industrial Products - open a new tab., which came into effect during the year, allows EU producers to better protect craft and industrial products and know-how associated with their region.

How will the Unitary Patent system work?

Inventors apply for a European patent.

The European Patent Office ensures that the invention meets the criteria of novelty, inventive step and industrial applicability.

After being granted the European patent, the holder requests that it be given unitary effect.

The Unitary Patent becomes effective in one step, without extra formalities such as translations, in the participating Member States:

Belgium, Bulgaria, Denmark, Germany, Estonia, France, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Austria, Portugal, Slovenia, Finland, Sweden.

In parallel, the European patent holder can also validate it in non-participating countries, including non-EU countries, subject to their national requirements.

With the proposed reform of the EU design protection legislation - open a new tab., innovation and design protection in the EU will also be strengthened, streamlined and modernised.

Finally, the EU is supporting cross-border business by eliminating barriers that impede economic growth and business.

New measures to address barriers could add €713 billion to the economy by the end of 2029.

One example is the proposed new rules to eliminate barriers to the free circulation of non-road mobile machinery - open a new tab., such as cranes, harvesters and forklifts, on public roads.

The regulation on non-road mobile machinery will ultimately replace the various regulatory regimes that currently exist in the Member States, and will:

eliminate barriers to market entry and reduce market delays

reduce compliance costs, facilitate innovation and improve competitiveness

facilitate the use of machinery across intra-EU borders

ensure high and equal standards for the road safety of non-road mobile machinery across the EU

In addition, to make it easier for non-profit organisations to operate across borders, in September the Commission proposed a new legal form called the European cross-border association - open a new tab.. This will improve the functioning of the Single Market by removing legal and administrative barriers for non-profit associations that operate or want to operate in more than one Member State.

Finally, in December, the Commission put forward an amended proposal for a regulation to facilitate cross-border solutions - open a new tab.. This aims to assist Member States in resolving obstacles that affect the daily lives of the 150 million citizens living in the EU’s cross-border regions. Tackling these obstacles will significantly improve the functioning of the Single Market and strengthen the economic, social and territorial cohesion of the EU.

Boosting long-term competitiveness

In the context of strong global competition and new geopolitical challenges, the Commission has proposed focusing on nine key drivers to boost the EU’s long-term competitiveness - open a new tab.. These are a properly functioning Single Market, access to private capital, public investment and infrastructure, research and innovation, energy, circularity, digitalisation, education and skills, and trade and open strategic autonomy.

The EU also ensures long-term competitiveness and a thriving Single Market by uniformly applying rules aimed at maintaining fair competition across all Member States and businesses. The Commission’s antitrust, merger and State-aid-control decisions ensure a balanced and efficient internal market, which is crucial for the EU’s economy. State-aid control ensures that government subsidies align with shared goals and maintain consistent business conditions throughout the EU. Vibrant private-sector competition leads to better quality and fairer prices for consumers. Every competition-policy decision by the Commission upholds consumer and business interests, while also protecting people in the EU from unscrupulous economic players.

The nine drivers of competitiveness

A growth-enhancing regulatory framework has nine drivers for competitiveness, with a functioning Single Market at its core. This Single Market functions through sustainable competitiveness, made possible by four components: 1. environmental sustainability; 2. resilience and stability; 3. well-being for all and fairness; 4. productivity. The remaining eight drivers of competitiveness are access to private capital, public investment and infrastructure, research and innovation, energy, circularity, digitalisation, education and skills, and trade and open strategic autonomy.

The Digital Markets Act - open a new tab. is a good example of how competition policy benefits the public. The act, which complements EU competition rules without replacing them, is one of the first pieces of legislation in the world to curb the gatekeeping power of major digital companies, resulting in economic and social benefits for citizens. (For more information, see Chapter 5.)

The EU not only ensures that internal competition is fair, but also checks that businesses in the EU have a fair chance to succeed when faced with international competition. In July, the EU introduced the Foreign Subsidies Regulation - open a new tab.. This allows the Commission to examine financial contributions given by non-EU governments to companies operating in the EU. If the contributions provide an unfair advantage to these companies, the Commission can take measures to correct the distortive effects.

The effectiveness of EU competition rules hinges on their implementation. Here are some ways in which the EU ensures fair competition by enforcing rules.

335 merger decisions were taken in 2023.

€487 billion of State aid was authorised during the year, especially in the context of Russia’s war of aggression against Ukraine and its implications for prices in the EU.

In June 2023, the Commission sent a Statement of Objections - open a new tab. to Google with its preliminary view that the company favours its own online display advertising technology services to the detriment of rivals.

Critical raw materials are indispensable to a wide range of strategic sectors, including net-zero technologies, the digital industry and the aerospace and defence sectors. The Critical Raw Materials Act - open a new tab. will improve the EU’s capacity to monitor and mitigate the risk of disruptions and enhance circularity and sustainability. Along with the reform of the electricity market design and the Net-Zero Industry Act, both of which were announced as part of the Green Deal Industrial Plan (see Chapters 3 and 4), this act will foster a regulatory environment conducive to the growth of net-zero technologies and the competitiveness of European industry.

The Net-Zero Industry Act - open a new tab. is also set to enhance the competitiveness of the EU economy by offering a better regulatory framework for industries. This will support their move towards green and digital innovations. As part of the Green Deal Industrial Plan, it will create a more predictable and simplified regulatory framework aimed at encouraging investment in the manufacturing of products essential to achieving the EU’s climate neutrality goals.

The act will also strengthen and make more resilient the EU’s industrial base in net-zero technologies, which are crucial to a cost-effective, reliable and sustainable clean-energy system. Furthermore, it will speed up the creation and production of net-zero technologies, helping to lessen the EU’s dependence on Russian fossil fuels and avoid new dependencies that could block key technologies and components needed for the green transition (see Chapter 4).

Improving economic security is another key factor in enhancing the competitiveness of the EU. In June, the Commission and the High Representative of the Union for Foreign Affairs and Security Policy, Josep Borrell, launched the European Economic Security Strategy - open a new tab. – a comprehensive approach aiming to make the EU economy stronger. This strategy will promote the development of the EU’s industrial base, protect its essential economic security interests and partner with the broadest possible range of non-EU countries to advance shared action to promote economic security at the international level. The strategy is essential for the EU to be able to assess and manage economic risks, while also preserving its openness and continuing to engage internationally.

Stronger EU–China relations to boost competitiveness

The EU’s relations with China are central to efforts to strengthen the EU’s competitiveness.

Faced with an increasingly assertive China that hardened its overall strategic posture, in 2023 the EU rolled out the approach of de-risking and rebalancing its relationship with China, while continuing to work towards a stronger rules-based international order.

Rebalancing involves the continuation of bilateral economic relations and cooperation on global challenges with China, while also addressing market distortions resulting from China’s disproportionate state subsidies.

De-risking includes reducing critical dependencies and tackling specific risks relating to China’s strategy to advance its military development by exploiting innovations stemming from joint research, academia and international private firms.

Financial systems

The capital markets union

Capital markets are financial markets where securities, such as stocks and bonds, are bought and sold. They allow businesses, governments and other entities to raise capital from a wide range of investors. The capital markets union - open a new tab. is the EU’s initiative to create a single market for capital, allowing cross-border capital flows and giving EU companies, including SMEs, access to more sources of funding.

To boost investment, investors need to feel protected and confident that their investments will yield worthwhile returns. This is why one of the main goals of the EU’s 2020 Capital Markets Union Action Plan - open a new tab. is to make the EU a safer place for people to invest their savings in the long term.

On 24 May 2023, the Commission adopted a retail investment package - open a new tab. that will empower and protect retail investors. Retail investors are individual, non-professional investors who invest in capital markets to manage their finances, including preparing for retirement needs. The EU wants to ensure that retail investors are duly protected and treated fairly when investing, so that they can take full advantage of the capital markets union to make their wealth grow. Boosting investor confidence and improving the capital markets union are also essential means of channelling private funding into the EU economy and funding the green and digital transitions.

What is the problem?

Retail investors are struggling to access relevant, comparable and easily understandable information to make informed investment choices.

Social media and new marketing channels are increasingly putting retail investors at risk of undue influence.

Financial advice may not always be in the best interests of retail investors.

Some investment products do not offer value for money to the retail investor.

Consequences

Only 17 % of EU household assets were held in financial securities (such as stocks or bonds) in 2021, well below the level for US households. (Source: Eurostat - open a new tab..)

40 %-higher fees are paid by retail investors compared with institutional investors (e.g. pension funds). (Source: European Securities and Markets Authority costs and performance report - open a new tab., January 2023.)

45 % of people in the EU are not confident that the investment advice they receive from financial intermediaries is in their best interests. (Source: Flash Eurobarometer 525 - open a new tab., July 2023.)

In May, the Parliament and the Council also agreed on a proposal to establish a single access point for all public financial and sustainability-related information about EU companies and EU investment products. This will increase companies’ visibility among investors, opening up additional financing sources. This is particularly important for small companies in small capital markets. The European Single Access Point - open a new tab. will also provide easy access to corporate sustainability reports published by companies, which will support the objectives of the European Green Deal.

In addition, the Parliament and the Council agreed on a legislative proposal to revise the regulation governing rules about the structure of the markets in financial instruments - open a new tab. on 29 June. The revision will ensure that the right conditions for a consolidated tape provider are in place to deliver a consolidated view of trading across the EU. The consolidated tape will gather the prices and volumes of financial instruments, such as shares and bonds, from hundreds of execution venues across the Member States into a single stream of information, making it equally accessible to everybody. All execution platforms, such as stock exchanges and trading platforms, will be required to contribute their trading data directly to the consolidated tape.

On 19 July, the Parliament and the Council agreed on a proposal to improve the regulatory framework applicable to the investment fund industry - open a new tab.. The revision harmonises the rules governing the selection and use of liquidity management tools relating to funds, bringing them into line with international recommendations on supporting financial stability. It also establishes a common framework for funds that give loans to companies (loan-originating funds) and enhances transparency on delegation rules, ensuring supervisors understand how much fund managers depend on third-party expertise.

Together, the three aforementioned proposals will ensure that investors have better access to company and trading data. The measures will also encourage long-term investment and make it easier and safer for investment funds to be sold across borders. Overall, the proposals will better connect EU companies with investors, improving companies’ access to funding, broadening investment opportunities for retail investors and further integrating EU capital markets.

In November, the EU updated the Central Securities Depositories Regulation - open a new tab.. This regulation was originally introduced to improve the safety and efficiency of settlement activities in financial markets, namely the completion of a securities transaction through the transfer of cash, securities or both. The revised legislation - open a new tab. will improve the EU’s capital markets and financial system by providing more proportionate and effective rules to reduce compliance costs and regulatory burdens for central securities depositories, facilitating their ability to offer a broader range of cross-border services and improving their cross-border supervision.

What is a consolidated tape?

It is a system that consolidates transaction information from EU trading platforms in real time, or as close as possible to real time.

It allows both professional and retail investors to see the price of and other information about a financial instrument (such as the volume and time of transactions) in one place.

Without a consolidated tape, information on trading is scattered across multiple execution platforms, such as stock exchanges, other trading venues and investment banks (also called ‘systematic internalisers’).

Central securities depositories - open a new tab. are specialised financial institutions that hold and administer securities (such as stocks and bonds), ensuring their safekeeping and enabling securities transactions to be processed efficiently. They underpin the functioning of modern financial markets.

In December, a political agreement was reached on the Commission’s proposals - open a new tab. to strengthen the insurance regulatory framework. This update will modernise the Solvency II Directive - open a new tab. by giving better incentives to the insurance and reinsurance (i.e. insurance for insurance companies) sector to invest more in long-term capital in line with the objectives of the capital markets union. It will also ensure this sector remains strong in difficult economic times and protects consumers’ interests. The new rules will take better account of certain risks, including those relating to climate change, and will make insurers’ financial strength less sensitive to short-term market fluctuations. They will also introduce a new (re)insurance undertakings recovery and resolution directive - open a new tab., to ensure financial stability and protect policyholders and taxpayers in the event of a (re)insurer’s failure. This directive will require larger and systemically important entities to formulate pre-emptive recovery plans to ensure they are prepared for crises. In addition, national authorities will have the tools to tackle problems with failing (re)insurers, including by taking them off the market in an orderly way while preserving the continuity of insurance coverage as much as possible.

Finally, 2023 saw the Commission helping Member States strengthen their national capital markets - open a new tab.. So far, 21 Member States have benefited from the Technical Support Instrument in this field. Reforms contributed to removing regulatory barriers to investment and tackling market inefficiencies. The objectives of these reform projects are to increase investment opportunities, bring higher market visibility for businesses and help SMEs access bank credit.

Digital finance

On 28 June, the Commission put forward two proposals - open a new tab. to ensure that people can pay with the European Central Bank-issued euro in the form they find most convenient.

The first proposal is about protecting the use of cash. The proposal was put in place to ensure that cash remains widely accepted as a means of payment and is easily accessible for people and businesses across the euro area.

The second proposal is to establish a legal framework for a potential digital euro, which the Central Bank may issue in the future as a complement to cash. In October, having investigated the possibility of introducing the digital euro for the previous 2 years, the Bank decided to move to the preparatory phase.

While cash will remain widely accessible and accepted, more and more citizens and businesses are choosing to pay electronically. The aim of the digital euro is to provide an additional option, on top of current private payment options. It would offer a way to pay digitally with a form of public money that is widely accepted, cheap, secure and resilient in the euro area (and potentially beyond).

The Central Bank may decide to issue the digital euro only after the digital euro proposal is adopted by the European Parliament and the Council.

Benefits of the digital euro for people

Using the digital euro anywhere in the euro area (other private digital payment solutions do not always offer this option).

Easier to use than existing digital payment solutions.

When using the digital euro offline, people’s privacy would be the same as when using cash.

Paying without access to the internet.

More choice for consumers.

Possibility to pay even without a bank account.

Free of charge for consumers.

Would the digital euro replace cash?

Absolutely not.

The digital euro would simply be a complement to cash and an alternative to today’s existing private digital solutions.

What about privacy?

When paying online, the bank would only have access to the personal data needed to perform the payments and to prevent fraud and fight money laundering.

This is the same as when paying with other digital means of payment, for example a credit card.

When paying offline, privacy is stronger than for any other digital means of payment – the bank would only see the same data as when withdrawing money from a cash machine.

Nobody would be able to see what people are paying for when using the digital euro offline.

The European Central Bank would not have access to people’s data.

Open finance and payments

With the rise of electronic payments, new service providers – such as entities providing open banking services – have emerged. More sophisticated types of fraud have also started to appear, putting consumers at risk. In response to these developments, and to ensure that the EU’s financial sector is capable of reaping the benefits of the ongoing digital transformation, the Commission proposed two sets of measures - open a new tab. on 28 June.

First, the Commission proposed to amend and modernise the current Payment Services Directive - open a new tab. (PSD2, which will become PSD3), and also proposed a payment services regulation. These changes will ensure consumers can continue to make electronic payments and transactions safely and securely in the EU. They aim to safeguard consumers’ rights while also providing a greater choice of payment service providers on the market.

The proposal for a revised payment services directive and new payment services regulation will:

make widely available a service to verify name–account matches before confirming transfers

help banks and other payment service providers cooperate against fraud through more fraud-related information sharing

give victims of fraud a right of refund by their bank or other payment service provider, in specific circumstances

oblige banks to improve customers’ awareness about fraud

Second, the Commission proposed a Framework for Financial Data Access - open a new tab.. This framework will establish clear rights and obligations relating to managing customer data sharing in the financial sector beyond payment accounts. In practice, this will lead to more innovative financial products and services for users and will stimulate competition in the financial sector.

The proposed package aims to ensure that the EU’s financial sector adapts to the ongoing digital transformation and to the risks and opportunities it presents.

On 7 November, a political agreement was reached between the Parliament and the Council on the Commission’s proposal - open a new tab. to make instant payments in euro available to all people and businesses with a bank account in the EU. The new rules, which modernise the Single Euro Payments Area Regulation - open a new tab., aim to ensure that instant payments in euro are affordable, secure and processed without obstacles across the EU. Instant payments offer fast and convenient solutions for people in everyday situations, such as receiving funds promptly (in under 10 seconds) in case of emergencies or splitting shared costs immediately in various social settings. They also improve cash-flow management for public administrations and businesses, especially SMEs; enable charities and non-governmental organisations to access funds quickly; and encourage banks to develop innovative financial services and products.

Financial data access has the following benefits

Sustainable finance

The main goal of the EU Sustainable Finance Framework - open a new tab. is to channel investment towards meeting the ambitious targets of the European Green Deal. Although implementation is advancing, further efforts are required to make the rules effective in practice and the tools user-friendly.

To enhance the framework’s efficiency and ease its implementation, the EU provides clear definitions of which economic activities qualify as environmentally sustainable, and how to demonstrate their degree of greenness. This is key in preventing greenwashing and ensuring that funds are allocated to sectors crucial for the green transition.

On 13 June, the Commission presented a package - open a new tab. to strengthen the EU Sustainable Finance Framework. This initiative supports companies and the financial sector by promoting private investment in transition projects and technologies and by channelling financial resources into sustainable investment. The package includes new criteria under the EU Taxonomy, expanding its classification system to encompass a broader range of economic activities through the EU Taxonomy Environmental and Climate Delegated Acts - open a new tab..

The diagram below illustrates the key new economic activities that are now recognised as being environmentally sustainable.

EU Taxonomy – economic sectors and activities covered

There are nine economic sectors and activities covered by the Climate Delegated Act and the Environmental Delegated Act. The taxonomy of what this coverage entails, and what has been added to these sectors, is as follows.

Disaster risk management is a newly added sector. It involves nature-based solutions, along with emergency services, flood-risk prevention and protection infrastructure.

Water supply and sewerage previously involved water supply, sewerage, waste management and remediation. It now also includes urban wastewater, sustainable drainage systems and phosphorus recovery from wastewater.

Transport previously covered low emissions, transitional alternatives until 2025 and infrastructure. It has been expanded to include new transitional water and air transport, and automotive and rail components.

Services is also a newly added sector. It covers the sale of spare parts and second-hand goods, along with the preparation of end-of-life products and components for reuse, and a marketplace for trading second-hand goods.

Forestry covers afforestation, conservation, forest management and the rehabilitation and restoration of forests.

ICT and professional activities formerly covered research, data solutions and data centres. It now also includes software and consultancy, and data-driven solutions for information and operational technologies.

Energy covers renewables, transmission and specific nuclear and natural gas activities (subject to stringent conditions).

Manufacturing previously involved enabling technologies and heavy industry (transitional). It now also covers plastic packaging goods, electrical and electronic equipment and pharmaceuticals.

Finally, the buildings sector formerly covered construction, energy-efficiency measures and renovations. It now also extends to demolition, road maintenance and the use of concrete in civil engineering.

The package also includes a recommendation on transition finance, providing guidance and practical examples for companies and the financial sector. These show how companies can use various of the framework’s tools on a voluntary basis to channel investment towards the green transition and manage their risks stemming from climate change and environmental degradation.

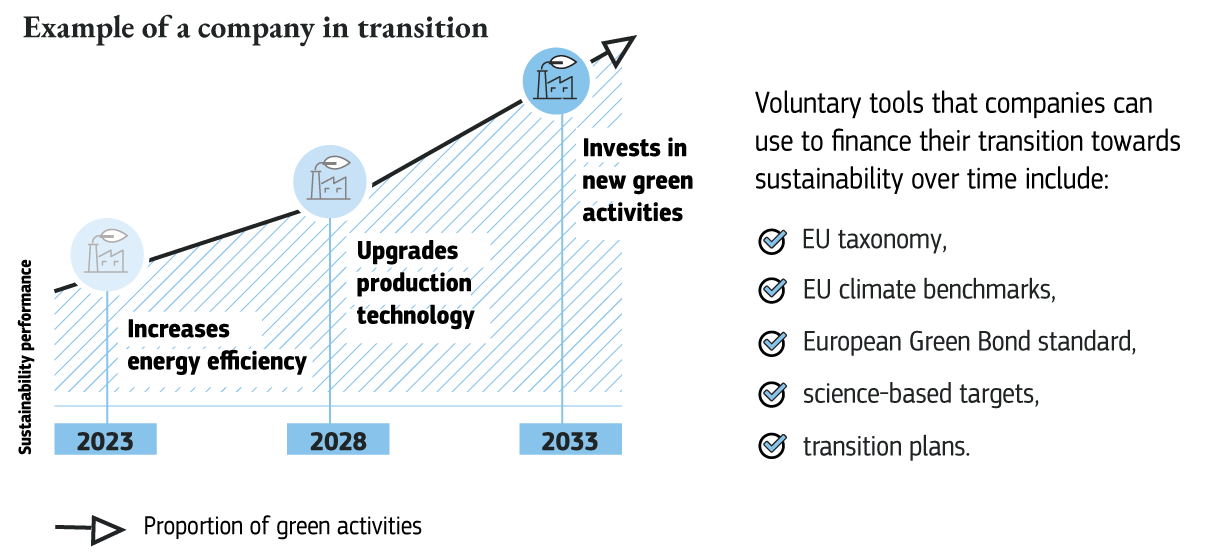

Tools for financing the green transition

The graph visually represents the pathway of a company’s transition towards sustainability, correlating the timeline from 2023 to 2033 with improvements in sustainability performance and an increasing proportion of green activities.

As the proportion of green activities in a company increases over time, its sustainability performance also increases. A rising green graph line also indicates progressive steps, starting with increasing energy efficiency, then upgrading production technology and eventually investing in new green activities. Voluntary tools that companies can use to finance their transition towards sustainability over time include the EU Taxonomy, EU climate benchmarks, the European Green Bond standard, science-based targets and transition plans.

Environmental, social and governance (ESG) ratings also play an important role in the EU’s sustainable finance market, as they provide information to investors and financial institutions regarding, for example, investment strategies relating to and risk management of ESG factors. In June 2023, the Commission proposed a regulation - open a new tab. that will address the ESG rating market’s lack of transparency, making it more reliable. New organisational principles and clear rules on the prevention of conflicts of interest will increase the integrity of ESG rating providers’ operations.

What is changing with the environmental, social and governance (ESG)

ratings proposal?

Previously, the lack of clarity about methodologies, data sources and providers’ operations led investors to distrust the quality of Environmental, Social and Governance ratings. Companies were uncertain whether these ratings accurately reflected their performance, complicating informed decision-making.

Consequently, the Single Market’s potential to support the European Green Deal and the UN Sustainable Development Goals was not fully realised. The proposed changes strive to introduce greater transparency and integrity, with greater clarity about objectives, methodologies and data sources, along with stricter authorisation and supervision requirements. These measures are expected to enable investors and companies to make more informed decisions, thereby enhancing the Single Market’s efficiency and contributing to the advancement of the EU’s Green Deal and the UN Sustainable Development Goals.

To ensure that companies report sustainability information in a harmonised way, the Commission also adopted the first set of mandatory European Sustainability Reporting Standards - open a new tab. in July 2023. The standards cover ESG issues, including climate change, biodiversity and human rights. They provide information for investors to help them understand the sustainability impact of the companies in which they invest. They also take account of discussions with the International Sustainability Standards Board - open a new tab. and the Global Reporting Initiative - open a new tab. to ensure a high degree of interoperability between EU and global standards and to prevent unnecessary double reporting by companies.

The European Green Deal - open a new tab. of 11 December 2019 underlined the importance of channelling financial and capital resources towards green investment. Green bonds play an increasingly important role in financing assets needed for the low-carbon transition. On 28 February 2023, the Parliament and the Council reached an agreement - open a new tab. on the proposal for a European Green Bonds Regulation - open a new tab. to establish an official green bond standard. The regulation came into force in December. A green bond standard is a set of criteria that provides a framework for issuing green bonds. The European Green Bond Standard ensures that green bonds finance projects with genuine environmental benefits and helps maintain integrity and trust in the green bond market. Issuers of European green bonds would need to ensure that at least 85 % of the funds raised by the bond are allocated to economic activities that align with the Taxonomy Regulation - open a new tab.. The new legislation also establishes a framework for the authorisation and supervision of third-party reviewers, which will help verify the features of the bonds, thereby improving trust in green claims.

Banking

Following the 2007–2008 global financial crisis, substantial work was done to make sure that EU banks became more resilient. Thanks to these efforts, the EU’s financial institutions have fared well throughout more recent crises, such as the COVID-19 pandemic, Russia’s war of aggression against Ukraine and the US banking crisis in spring 2023. Today, EU banks are well capitalised, highly liquid and well supervised. As shown by the 2023 stress tests - open a new tab. carried out by the European Banking Authority, they are resilient even in very adverse scenarios.

To further strengthen banks, the Commission adopted a proposal on 18 April to reform the EU’s existing bank crisis management and deposit insurance framework - open a new tab.. The focus is on medium-sized and smaller banks. In the past, many failing small and medium-sized banks were helped using methods outside the established resolution framework. Sometimes this meant using public funds (taxpayers’ money) instead of the bank’s own money or other backup funds financed by the industry and designed to protect depositors (deposit guarantee schemes and resolution funds). The reformed framework will facilitate the use of industry-funded safety nets to shield depositors in banking crises, such as by transferring them from an ailing bank to a healthy one. The use of such safety nets must only be a complement to the banks’ own reserves, which remain the first line of defence.

Bank crisis management and deposit insurance framework reform

Objectives

Preserve financial stability and protect taxpayers’ money

Improve protection for depositors

Shield the real economy from the impact of bank failure

What are we doing?

Improving bank-failure systems and depositor protection, especially for small and medium-sized banks

Small and medium-sized banks

Business model with high share of deposits in the balance sheet

The aim of the reform is to maintain financial stability and protect taxpayers’ money. At the same time, depositors are to be better protected and the real economy shielded from the effects of bank failures. The aim is to improve the systems for bank failures and depositor protection, particularly for small and medium-sized banks.

Before the reform, shareholders and creditors were the first to bear the losses in the event of a bank failure, followed by depositors and the national resolution fund or the Single Resolution Fund (in the banking union). After the reform, shareholders and creditors will continue to be first in line in the event of a bank failure, followed by the Deposit Guarantee Scheme, instead of depositors, and then the national resolution fund or Single Resolution Fund (in the banking union). This new regulation aims to make the banking system more resilient, which will particularly benefit business models with a high proportion of deposits.

Another important breakthrough during the year was the political agreement - open a new tab. on the Commission’s proposal for a review of the EU’s banking rules - open a new tab. (the Capital Requirements Regulation and the Capital Requirements Directive), known as the banking package - open a new tab.. This package implements the final set of international banking regulation standards (the Basel III standards - open a new tab.) agreed by the EU and its G20 partners in the Basel Committee on Banking Supervision. The initial phase of the Basel III reforms – mandating higher and better-quality capital, reduced leverage and strict liquidity requirements – is already in effect in all EU banks. With the completion of these standards, the EU seeks to enhance the regulatory framework’s simplicity, comparability and risk sensitivity, ultimately restoring confidence in risk-based capital requirements.

What is in the banking package?

Basel III: new rules on internal models

A new limit will be introduced to ensure risks are not underestimated when banks use their own calculation models.

Better supervision

Supervisors will have stronger tools to oversee EU banks, including complex banking groups. Minimum standards will be introduced to supervise non-EU banks in the EU.

Sustainability

Banks will be required to take environmental, social and governance risks into account when managing their business.

Fair, simple and modern taxation and customs

Reform of the customs union

In May, the Commission proposed the most ambitious reform of the customs union - open a new tab. since its establishment in 1968, in response to increased trade volumes, e-commerce growth and higher EU standards. The current system’s digital fragmentation and suboptimal coordination between national authorities have raised administrative compliance costs for traders and opened avenues for fraud.

The reform includes the establishment of an EU customs authority, which will oversee a new customs data hub - open a new tab.. This will lead to a more centralised and digitalised approach to customs that should lower compliance costs for traders, free up resources for national authorities and ensure a more efficient, strengthened and fraud-proof customs union.

Tackling tax evasion and tax fraud

New reporting and information-exchange requirements, in line with the Organisation for Economic Co-operation and Development’s Crypto Asset Reporting Framework, will assist the Member States in addressing tax evasion and fraud in the crypto-asset and e-money sectors. The agreement - open a new tab. reached in 2023 requires all EU-based crypto-asset providers to report transactions by clients residing in the EU, enhancing the detection of tax fraud and avoidance.

As part of the 2020 Capital Markets Union Action Plan and the Action Plan for Fair and Simple Taxation Supporting the EU’s Recovery - open a new tab., the Commission proposed streamlining withholding-tax procedures for investors, financial intermediaries and tax administrations. This move aims to prevent both double taxation and abuses of the refund or relief system. It also seeks to harmonise the procedures for seeking relief from withholding taxes, thereby reducing costs for stakeholders.

The Commission also proposed a directive on transfer pricing - open a new tab., aimed at reducing the compliance burden, increasing tax certainty and reducing disputes about transfer pricing. This is intended to prevent both double taxation and instances of double non-taxation.

Towards fairer, simpler and more modern taxation

Dealing with 27 different national tax systems, each with its specific rules, makes it costly for companies when it comes to tax compliance. This discourages cross-border investment in the EU, putting businesses at a competitive disadvantage compared to elsewhere in the world.

To address this issue, in September the Commission adopted the business in Europe: framework for income taxation - open a new tab. proposal. This framework would introduce a unified set of rules for determining the tax base for groups of companies. This will reduce compliance costs by up to 65 % for large businesses operating in multiple Member States. Additionally, it will simplify the process for national tax authorities, making it easier to determine the correct taxes due.

While the proposal is mainly aimed at large groups operating across the European Union, the EU has also taken measures to simplify tax rules for micro companies and SMEs. The proposed directive on head office taxation - open a new tab. introduces a simplification framework for SMEs operating in other Member States through permanent establishments. It gives them the option to interact with just one tax administration (or head office) rather than the tax offices of all of the Member States in which they operate. This aims to encourage cross-border expansion.