The EU’s financial landscape A patchwork construction requiring further simplification and accountability

About the report:The EU’s financial landscape has evolved over decades. Its centrepiece is the EU budget, which includes a number of instruments. This landscape also covers instruments outside the budget, which have multiplied in recent years. Our audit provides an insight into the design of the current arrangements and identifies the potential scope for simplifying and streamlining the financial landscape. We conclude that, even if there were reasons for creating instruments outside the budget, the piecemeal approach to the setup of the EU’s financial landscape has resulted in a patchwork construction that is not fully publicly accountable. Our recommendations aim at ensuring adequate prior assessments of newly proposed instruments, further consolidating the EU’s financial landscape and improving its accountability.

ECA special report pursuant to Article 287(4), second subparagraph, TFEU.

Executive summary

I The EU’s financial landscape has evolved over decades. Its centrepiece is the EU budget and the instruments fully integrated into it, but it also includes instruments outside the EU budget. Such newly created instruments have multiplied over the last 15 years. This was mainly in response to different crises, and was also due to legal and practical constraints on using existing instruments. The multiplication of instruments has made it timely for us to carry out a broad analysis of the landscape.

II The degree of efficiency and transparency of the EU’s financial landscape have attracted considerable attention from EU stakeholders in the context of potential institutional reform. The European Parliament in particular has described the EU’s financial landscape as a “galaxy of funds and instruments around the EU budget”.

III Our audit aimed to provide insight into the design of the current arrangements, and to identify the potential scope for simplifying and streamlining the EU’s financial landscape, based on an analysis of selected instruments. We assessed whether the multiplication and diversity of instruments in the EU’s financial landscape are justified. For the purposes of our audit, we examined the reasons for creating instruments outside the EU budget. We also assessed whether the existing arrangements ensure adequate public scrutiny of funding for EU policies, and if appropriate action is being taken for the 2021-2027 period to improve the integration of the EU’s financial landscape.

IV We conclude that, even if there were reasons for creating new types of instruments, the piecemeal approach to the setup of the EU’s financial landscape has resulted in a patchwork construction.

V We found that the EU’s financial landscape is composed of many instruments with a variety of governance arrangements and sources of funds, and different coverage of potential liabilities, leading to a patchwork of different components. There were generally valid reasons for creating these instruments, but most of them did not follow good practice by including clear evidence that the option selected and its design were the most suitable.

VI We also found that the EU has introduced integrated reporting, but not all instruments are covered. The ECA does not have the mandate to audit some instruments outside the EU budget. For some of those instruments there is a gap in the audit of their performance and no European Parliament oversight. The EU’s financial landscape is therefore not fully publicly accountable.

VII We note the recent progress made on consolidating several instruments. However, the potential for simplification has not yet been fully exploited, in particular for those instruments providing financial assistance.

VIII We recommend that the Commission should:

- ensure that any new instrument it proposes contains an assessment of the design and options chosen, and share this good practice with the Council;

- compile and publish information on the EU’s overall financial landscape;

- propose to integrate the Modernisation Fund into the EU budget;

- propose the integration and consolidation of existing financial assistance instruments.

Introduction

The development of the EU’s financial landscape

01 In the 1950s, the Member States established the European Coal and Steel Community (the 1951 Treaty1), the European Economic Community (the 1957 EEC Treaty2) and the European Atomic Energy Community (the 1957 Euratom Treaty3) with distinct legal identities, their own governance arrangements and separate budgets. The 1957 EEC Treaty also established the European Investment Bank (EIB) as a separate entity to act as the EEC’s ‘lending arm’, as well as the European Development Fund (EDF) with its own multiannual budget to provide grants and loans to certain non-EU countries.

02 By 1970, the different budgets were incorporated into the EEC budget, creating a single Communities budget (the general budget) covering administrative and operational expenditure, which was mainly used to finance spending programmes. The vast majority of the EU budget is used to finance spending programmes that provide grants, subsidies or other non-repayable forms of financial support to beneficiaries. As at 1 January 2021, there were 43 spending programmes funded by the EU budget.

03 The 1970 Luxembourg Treaty4 also led to the gradual replacement of Member State contributions by a system of ‘own resources’ (based on Value-Added Tax (VAT) and customs duties). In the 1970s, the general budget also provided new types of financial support. Firstly, the New Community Instrument enabled the Communities to provide loans, equity and other repayable financial support to small and medium-sized firms. Secondly, the general budget was used to guarantee EIB loans for micro-economic purposes in Mediterranean countries. Thirdly, following the 1973 oil price shock, the Communities’ general budget guaranteed borrowing and lending to provide financial assistance loans to Member States in difficulties (the Balance of Payments (BoP) Facility).

04 The 1975 Brussels Treaty5 established a budgetary authority – comprising the Council and the European Parliament– to adopt and scrutinise the implementation of the general budget, and designating the European Court of Auditors (ECA) as the auditor of all revenue and expenditure. In addition, the Member States also established the first decentralised agencies. These agencies carry out technical, scientific or managerial tasks that help the EU institutions to devise and implement policies. Most decentralised agencies are funded from the EU budget or charge fees for their services, and are audited by the ECA and scrutinised by the budgetary authority. As at 31 December 2021, the EU had 35 decentralised agencies.

05 In 1988, the Council and the European Parliament agreed the first long-term budget, the 1988-1992 financial perspectives6, which introduce an annual limit on general budget expenditure – the own resources ceiling7 – expressed as a percentage of the total Gross National Product (GNP) of the Member States (1.2 % for 1992).

06 Under the 1993-1999 Financial Perspectives8, Member States agreed annual limits for spending on agriculture, structural operations, internal policies, external policies, administrative expenditure, and reserves (‘headings’). They also agreed a new own resource based on GNP to act as the balancing resource of the EU budget.

07 The 2000-2006 Financial Perspectives9 included an administrative reform that entailed new financial management arrangements, including the establishment of executive agencies (seven at the end of 2021) to manage certain spending programmes under the Commission’s direct management. Furthermore, Gross National Income (GNI) replaced GNP as the basis for calculating the balancing own resource.

08 The 2007-2013 Multiannual Financial Framework (MFF)10 increased the volume of emergency reserves (special instruments), in particular the new European Globalisation Adjustment Fund to help workers after restructuring; the European Union Solidarity Fund to respond to major natural disasters; and the Emergency Aid Reserve to respond to crises in non-EU countries. The EU also introduced the first public-private partnerships to achieve specific technological goals (Joint Technology Initiatives) funded by the EU and partners from industry or government.

09 In addition, the 2008-2010 financial crisis led to increased use of financial assistance instruments. In 2009, the Member States reactivated the BoP Facility to provide loans to non-euro area Member States. In 2010, for the euro area, the Member States established the Greek Loan Facility (GLF) based on coordinated bilateral loans; the European Financial Stability Facility (EFSF) which was used to provide assistance to Ireland, Portugal and Greece, and was based on direct guarantees of loans by euro area Member States; and the European Financial Stabilisation Mechanism (EFSM) to support any EU country in severe financial difficulties, which was based on loans guaranteed by the own resources ceiling. In 2012, the euro area Member States set up the European Stability Mechanism (ESM) to take over, from the EFSM and EFSF, the granting of new euro area financial assistance.

10 Under the 2014-2020 MFF11, the Member States and the EU agreed to make greater use of instruments designed to leverage other sources of public and private finance. This included setting up Trust Funds outside the EU budget, which combined EU budget contributions with finance from other donors to provide external aid to specific countries. The EU also expanded its use of public and private partnerships in research and innovation, replacing the former Joint Technology Initiatives with Joint Undertakings (eight as at 31 December 2021). In addition, the EU decided to make greater use of EU budget contributions to create ‘pools’ of funding to enable financial partners such as the EIB to provide loans, equity investments or other repayable financial support for projects and enterprises (financial instruments).

11 During the above period, EU budget guarantees were used to raise finance for repayable investment support both within and outside the EU, namely the EIB external lending mandate in 2014 to support investment projects outside the EU, the European Fund for Strategic Investments (EFSI) in 2015 to boost long-term economic growth and competitiveness in the EU, and the European Fund for Sustainable Development (EFSD) in 2016 to support sustainable development in Africa and the EU’s neighbourhood. In 2020, in order to address the socio-economic effects of COVID-19, the Member States and the EU established SURE, a borrowing and lending instrument, to provide “temporary support to mitigate unemployment risks in an emergency” with its loans to Member States guaranteed by the own resources ceiling . The Member States also provided guarantees that cover 25 % of the total amount of the loans. In addition, the EU set up the Single Resolution Fund (SRF) outside the EU budget, which was funded by fees levied on banks to help deal with failing banks.

12 For the current 2021-2027 period, the EU has adopted a package of legislation related to the EU’s finances. This includes the MFF12 regulation and the accompanying sectoral legislation governing the EU’s spending programmes. The EDF has been incorporated into the EU budget, and the InvestEU programme has replaced the EFSI and centrally managed financial instruments. The Member States established and financed the European Peace Facility (EPF) outside the EU budget to finance certain costs related to the Common Security and Defence Policy. In addition, the EU’s special instruments were updated and expanded. The Council has also established the NextGenerationEU to provide additional EU finance for spending and investment from 2021 to 2026 to tackle the economic effects of COVID-19. During 2022 the ECA has issued opinions 07/202213 and 08/202214 regarding the Commission’s and Council’s proposals, respectively to introduce the Macro-financial assistance plus and the Social Climate Fund.

13 In this report, we use the term ‘instrument’ to refer to all types of financing for EU policies, which are called ‘instruments’, ‘mechanisms’, ‘funds’, ‘facilities’ or ‘endowments’ in EU legislative acts. We also use the term ‘instrument’ to refer to specific types of finance provided by institutions such as the ESM and the EIB. Figure 1 presents the timeline of creation of the instruments described in the previous paragraphs, and shows how the number of instruments has multiplied over the last 15 years.

Note: The full names of each abbreviation are in the list of abbreviations and the glossary.

Source: ECA.

The EU’s current financial landscape

14 The Treaty on the Functioning of the EU stipulates the key principles for budgetary management15. Those principles are further explained in the Financial Regulation16. Box 1 presents the budgetary principles included in the Financial Regulation. New instruments may breach the budgetary principles in a number of ways. For example, establishing spending programmes by intergovernmental agreement would breach the principle of unity; dedicating certain revenue sources to specific expenditure would derogate from the principle of universality; and the complexity resulting from the proliferation of instruments would undermine performance and transparency.

Budgetary Principles included in the Financial Regulation

Principles of unity and budget accuracy: the budget shall forecast all revenue and expenditure considered necessary for the Union;

Principle of annuality: the budget shall be authorised for a financial year running from 1 January to 31 December;

Principle of equilibrium: revenue and expenditure shall be in balance;

Principle of unit of account: the budget shall be drawn up in euros;

Principle of universality: total revenue shall cover total expenditure;

Principle of specification: amounts shall be earmarked for specific purposes by title and chapter;

Principle of sound financial management and performance: economy, efficiency and effectiveness shall be used, together with a focus on performance;

Principle of transparency: the budget shall be established and implemented, and the accounts presented in accordance with the principle of transparency.

15 The EU budget17 is adopted annually. It must respect the limits on expenditure18 set out in the MFF regulation and the ultimate ‘ceiling’ on the resources that the EU can collect from the Member States in the own resources decision (see Figure 2), which requires unanimity in the Council and approval by Member States according to their constitutional requirements.

Source: ECA, based on the own resources decision and the MFF regulation.

16 The margin between the expenditure limits set in the MFF and the own resources ceiling is called ‘headroom’. This headroom, after taking into consideration a safety buffer to cover potential negative economic developments, is used to guarantee the EU’s financial obligations and potential losses (‘contingent liabilities’). To be able to borrow the necessary funds for NextGenerationEU in the markets, a temporary ring-fenced additional ceiling of 0.6 % of EU GNI was introduced in the own resources decision. The MFF ceiling for expenditure by the EU budget (approximately 1 %) is now around half of the overall own resources ceiling (2 %).

17 For the purpose of this report, we consider an instrument as included in the EU budget when it is fully financed (or provisioned) in line with the MFF regulation and follows the methods of budget implementation presented in the Financial Regulation19 The following instruments are fully integrated into the EU budget:

- spending programmes and funds, financial instruments, and the EU agencies and other bodies20 (such as Joint Undertakings) funded by the EU budget to implement EU policies;

- the special instruments for responding to events financed by the EU budget, such as the Solidarity and Emergency Aid Reserve (SEAR), the Single Margin Instrument (SMI), and the European Globalisation Adjustment Fund for Displaced Workers (EGF);

- external assigned revenue. This special type of revenue channels additional funds from external sources to the EU budget for specific expenditure. It comes on top of the adopted budget and the MFF, and should be assigned to a specific budget line. It includes non-EU countries’ financial contributions, the Innovation Fund (raising money from the Emissions Trading System (ETS) for innovative low-carbon technologies), and the non-repayable support part of NextGenerationEU financed by loans;

- budgetary guarantee instruments, such as InvestEU and EFSD+, where calls against the guarantee are paid from the EU budget up to the guarantee limit.

18 The instruments which lie outside the EU budget (off-budget) and involve borrowing and lending by the EU, but which are guaranteed under the own resources ceiling, are the following:

- financial assistance instruments for non-EU countries, such as the Macro-Financial Assistance (MFA) and EURATOM loans, where the Commission borrows funds from the capital markets and lends them to beneficiary countries on the same terms (back-to-back loans). These loans are ultimately covered by the EU budget;

- financial assistance to EU countries, such as the BoP, the EFSM and SURE, which also operate as back-to-back loans;

- Recovery and Resilience Facility (RRF) loans financed by NextGenerationEU borrowing.

19 The instruments established outside the EU budget and not covered by the own resources ceiling include:

- the financial assistance instruments of the ESM, EFSF and GLF, which are based on capital, guarantees or loans established under intergovernmental treaties or agreements;

- the various repayable investment instruments of the EIB group (own operations);

- other instruments providing the means to implement EU policies:

- the European Peace Facility (EPF);

- the Single Resolution Fund (SRF);

- the Modernisation Fund for Member States decarbonising their economies, and Member State spending to achieve decarbonisation using revenues from the Emissions Trading Scheme;

- grants from European Economic Area states, Norway and Switzerland to EU Member States that aim to reduce social and economic disparities within the European Economic Area and the EU.

20 The EU’s current financial landscape, which developed over decades, has been described by the European Parliament as a “galaxy of funds and instruments around the EU budget”. Figure 3 provides an overview of the EU’s financial landscape as at 1 January 2021. Annex I provides financial information about the instruments we include in our analysis, in particular their size/capacity.

Figure 3 – The EU’s financial landscape as at 1 January 2021

Note: The size of the bubbles in the picture does not represent the actual size of the instruments (see Annex I).

Source: ECA.

Audit scope and approach

21 The degree of efficiency and transparency of the EU’s financial landscape have attracted considerable attention from EU stakeholders in the context of potential institutional reform21. Our audit aims to provide an insight into the design of the current arrangements, and to identify the potential scope for simplifying and streamlining the EU’s financial landscape.

22 We examined whether the EU’s financial landscape is set up in a consistent way. In particular, we assessed whether:

- legitimate reasons existed for not fully integrating instruments into the EU budget when they were established;

- adequate provision has been made to ensure public accountability for the EU’s financial landscape, in terms of reporting, audit, and public scrutiny arrangements;

- appropriate action was taken to improve the integration of the EU’s financial landscape over time.

23 In the report, we cover instruments lying mainly outside the EU budget which are available to enter into new operations in the 2021-2027 period, or which continue to generate significant assets or potential liabilities (‘contingent’ liabilities) for the EU or Member States (see list in Annex I). We do not analyse the instruments that are fully integrated into the EU budget and do not generate contingent liabilities or are not based mainly on external assigned revenue, namely spending programmes and agencies or other bodies funded by the EU budget. In addition, our analysis does not cover non-EU countries’ grants and contributions to the EU budget22 and the Member States’ ETS revenues, as these are spent directly by Member States.

24 For the purpose of this assessment, we used as criteria the budgetary principles and rules laid down in the treaties, the own resources decision and the Financial Regulation. As benchmarks, we used international standards, best practices, and recommendations on good budgetary governance and public finance management (e.g. the Organisation for Economic Co-operation and Development23, the International Monetary Fund24, and Public Expenditure and Financial Accountability25).

25 We reviewed the proposals for the different instruments and the legal acts establishing them, and carried out interviews with officials from the Commission departments responsible for proposing or managing the different instruments. We also gathered information from the European Parliament, the Council, the ESM and the EIB Group in order to better understand the role of the different stakeholders in the EU’s financial landscape. In addition, we consulted a number of EU public finance experts to discuss our analysis and preliminary audit conclusions.

Observations

The EU’s financial landscape 2021 is a patchwork of different components

26 As Figure 3 shows, the EU’s financial landscape has a significant number of diverse components. To assess the justification for the multiplication and diversity of the instruments not fully integrated into the EU budget (see Annex I), the paragraphs below examine the reasons why they were created, the related governance arrangements, and sources of funding.

Legitimate reasons for creating new instruments, but many lacked appropriate prior evaluations

There was a legitimate reason for creating most of the instruments

27 The budgetary principles established in the Financial Regulation26 – in particular the principle of unity – state that the EU budget must forecast and authorise all revenue and expenditure considered necessary for the EU. The establishment of instruments outside the budgetary process should be legitimate and appropriately justified27. We analysed whether there was a legitimate reason for the type of instrument chosen and, where applicable, for it being created outside the EU budget.

28 We found that, in most cases, the legal, political or economic circumstances at the time each instrument was created provided reasons for their off-budget aspects. The instruments based on borrowing and lending that provide financial assistance (see Figure 3) had to be developed outside the EU budget, because loans cannot be raised within it. These instruments were mostly created to respond to crises. The GLF was the political option found to respond quickly to the immediate needs to finance Greece. The EFSF was a temporary solution to address the 2010 sovereign debt crisis, and was succeeded by the ESM. Divergences between euro area and non-euro area Member States led to these three instruments being created outside the own resources ceiling.

29 The BoP was also created in the 1970s to respond to crises and support Member States that have problems with their balance of payments. Similarly, the MFA was created to provide financial assistance to non-EU countries. The EFSM was set up at the same time and with the same objectives as the EFSF, but could be accommodated under the coverage of the own resources ceiling. SURE and NextGenerationEU were the EU response to the economic and social effects of the COVID-19 pandemic.

30 Other instruments were created inside the budget to leverage EU funds by providing EU budget guarantees. They were established so that to allow using the EU budget funds to provide repayable support and mobilise the resources needed to finance EU action by the financial institutions. This type of support goes beyond the non-repayable support typically provided by the EU budget. It is used to provide economic stimulus in response to crises by addressing identified investment gaps. InvestEU and EFSD+ are the two instruments created for this purpose.

31 The establishment of the European Peace Facility outside the EU budget is justified by the legal constraints stemming from Article 41(2) of the Treaty on European Union (TEU), which prevents the EU budget from financing operating expenditure with military or defence implications. The off-budget nature of the European Peace Facility allows Member States to overcome this limitation.

32 The SRF is a resolution financing arrangement. It is one of the measures proposed to strengthen Europe's banking sector and to avoid the spillover effects of any future failing banks with negative effects on depositors and taxpayers. The fact that the SRF is fully financed from contributions from euro area banks (pooling of funds) explains that it is an instrument created outside the EU budget.

33 The Modernisation Fund and the Innovation Fund are both financed by ETS revenues. The two different designs of these funds were set out in the ETS Directive28 (see Box 4). Even though both funds provide non-repayable support (in a similar way to the EU budget), creating them meant that EU policies could be financed by pooling funds that would otherwise be used exclusively by Member States. In addition, these funds come on top of the EU budget and the MFF ceiling (1 % of EU GNI), and can thus be used to provide non-repayable support beyond those limits.

No clear demonstration that the most efficient option was chosen for the majority of instruments assessed

34 An appropriate ex-ante evaluation is important for justifying the creation of an instrument and assessing its potential efficiency. In the EU, the impact assessment plays a key role in this regard, and is envisaged by the Better Regulation Framework for Commission initiatives that are likely to have significant economic, environmental or social impacts29. The Better Regulation Framework envisages situations where an impact assessment cannot be carried out, or needs to be shortened or simplified. This is the case, for example, when there is political urgency.

35 We found that even though there was a justification for their creation (see paragraphs 27 to 32), the selected design (including the instruments’ off-budget characteristics) was not supported by impact assessments or similar ex-ante evaluations in most cases (out of the 16 instruments we analysed, 10 were not supported by impact assessments). For the instruments covered by the own resources ceiling, the Commission justified this by the urgent nature of the particular proposals to create the instruments (i.e. NextGenerationEU, SURE, and the EFSM). For the other cases, we consider that such an analysis would have been useful although an impact assessment was not formally required, as the particular instrument was not a Commission initiative (i.e. the European Peace Facility, the ESM, the EFSF, and the GLF), or was created before the requirement for impact assessments (i.e. BoP, EURATOM loans and MFA).

36 The lack of appropriate impact assessments or other similar evaluations also makes it impossible to justify that the creation of an off-budget instrument was better than using the EU budget, and to demonstrate that the proposed instrument was the most efficient one (cost-benefit analysis).

Sunset or review clauses are present in most of the instruments we analysed

37 Including sunset provisions when preparing a new instrument is good practice, and avoids unnecessary or redundant instruments in the long run30. The majority of the instruments we analysed contain a sunset clause specifying the duration of the instrument, or a regular review clause that requires the reasons for maintaining the instruments to be reviewed. Our analysis found that these clauses were implemented as stipulated by the legislative acts. The exception to this practice is the EURATOM loans facility, which does not contain such clauses (see Box 2).

The EURATOM loans facility: the lack of a review clause runs the risk of the instrument becoming outdated

The EURATOM loans facility has existed since 1977, and its most recent revision dates back to 2006, when the legal basis was adjusted to take account of the enlargement of the EU. The instrument was created to provide Member States with loans for their investment projects relating to nuclear power stations, and was later extended to provide loans to certain third countries (currently Russia, Ukraine and Armenia) for projects to increase the safety and efficiency of their nuclear power stations. Despite developments in EU energy policy and priorities, as well as changes in the geopolitical context, the Commission and the Council have not assessed the need to maintain the facility for the last 16 years.

A variety of governance arrangements, sources of funding and contingent liabilities

38 The instruments should be as consistent as possible, given their specific characteristics. The existence of a common framework, laying down general rules for creating and harmonising governance arrangements, can bring greater transparency, simplicity and effectiveness into the operation of the instruments31.

Governance arrangements vary substantially

39 In order to assess the level of consistency of the instruments within the EU’s financial landscape, we examined the different governance arrangements by checking the basic legislative acts and comparing the decision-making process for similar instruments. We also analysed the implications of the different governance arrangements.

40 The various instruments we analysed are grounded in different basic acts. These range from treaties concluded by a specific group of Member States (such as the ESM, signed by euro area Member States) to Council regulations (such as SURE). In the case of the MFA (see paragraph 83), the lack of a framework regulation means that decisions to grant loans and the respective conditions are taken on a case-by-case basis. The lack of a common framework for creating any new instrument leads to too diverse a range of governance arrangements.

41 While the above difference in governance arrangements might be explained to a certain extent by the instruments’ varied characteristics, we found that similar instruments within the EU’s financial landscape also have different governance arrangements. The governance of financial assistance instruments, for example, differs from one instrument to another (see Box 3).

Different governance arrangements for similar borrowing and lending instruments

The instruments that provide financial assistance for countries in need have similar characteristics because of their common objective to provide loans to Member States or non-EU countries (see Figure 3). Some of the instruments are covered by the own resources ceiling, and have different governance arrangements. BoP, EFSM, EURATOM loans and SURE’s main decisions are made by the Council, following proposals from the Commission. However, in general, MFA loans follow the ordinary legislative procedure, and require a single joint decision by the European Parliament and the Council.

The instruments not covered by the own resources ceiling are created by an intergovernmental Treaty or Agreement. They have different governance structures and the responsibility of decision-making processes lies solely with representatives of euro area Member States: the GLF is based on a one-off inter-creditor agreement, meaning that all decisions are taken by the parties to the creditor agreement; the EFSF and the ESM are managed by specific boards. This patchwork arrangement is a source of complexity, and entails the risk of duplication. It can also lead to a lack of synergies, and weakens governance and decision-making32.

42 In one case, the specific governance arrangements affect the Member State’s debt positions. The EFSF is a private company subject to Luxembourg law, and it is not considered an international organisation for the purpose of national accounts criteria. Therefore, the amounts borrowed by the EFSF must be recorded as government debt of the Member States that guarantee its capital33. This means that the loans obtained in the markets are reflected as debt in the Member States’ national accounts. This does not occur for similar instruments such as the ESM, or for those covered by the own resources decision ceiling (EFSM, BoP, MFA, EURATOM loans and SURE), as international organisations do not compile national accounts.

43 Other examples are the Innovation Fund and the Modernisation Fund, which are recently created instruments with similar sources of funding, type of support and objectives (see Box 4). Although both are non-repayable support schemes, they also have different governance arrangements: the main decisions about the Innovation Fund are taken by the Commission, while decisions about the Modernisation Fund are taken by an Investment Committee composed mostly of beneficiary Member States’ representatives.

The Modernisation Fund and the Innovation Fund: two sides of the same coin

The EU ETS: funding the two funds

The EU ETS is a system for controlling carbon emissions and other forms of atmospheric pollution. An upper limit is set on the amount that a given business or other organisation may produce, but allows further capacity to be bought from organisations that have not used their full allowances. In 2021, Member States collected more than €30 billion from auctioning these allowances. A small percentage is transferred to the Innovation Fund and the Modernisation Fund (the estimated amount can reach €38 and 51 billion for a 10-year period for each of the two funds, respectively).

The main objectives of the two funds: a transition to clean energy

Both funds have similar objectives, focusing on the energy sector and the decarbonisation of economies. The Innovation Fund is available to all 27 Member States, while the Modernisation Fund can be used only by the 10 Member States with a per capita Gross Domestic Product below 60 % of the EU average (Bulgaria, Czech Republic, Estonia, Croatia, Latvia, Lithuania, Hungary, Poland, Romania and Slovakia).

Governance differs significantly

While the Innovation Fund was integrated into the EU budget, the Modernisation Fund is managed completely outside it. This means that the Commission has full management responsibility for the Innovation Fund. Responsibility for managing the Modernisation Fund lies with the beneficiary Member States. The main decisions are taken by an investment committee composed of representatives from Member States. The EIB and the Commission appoint one representative each.

Sources of funding are diverse

44 In order to assess the level of consistency of the EU’s financial landscape, we examined the origin of funds used by the instruments, and grouped them according to the different sources.

45 We found that the ESM, EFSF, EFSM, BoP, MFA, EURATOM loans, NextGenerationEU, SURE and EIB own operations obtain funds by borrowing in the financial markets. The InvestEU and EFSD+ -supported financing and investment operations are selected and appraised by implementing partners for financing (albeit covered by a budgetary guarantee granted by the EU and partially provisioned by the EU budget). The Modernisation Fund and the Innovation Fund are financed by revenues from auctioning EU ETS allowances. The SRF is funded by the financial institutions belonging to the banking union, and the GLF consists of direct loans from euro area Member States to Greece. The European Peace Facility is funded by direct contributions from Member States. Figure 4 shows the diverse sources of funding for the instruments we analysed.

* EFSF, EIB own operations and ESM are financed by borrowing in capital markets, but Member States also provided some amounts as paid-in capital.

Source: ECA.

Contingent liabilities backed up differently

46 Effective management of assets and liabilities ensures that public investments provide value for money, assets are recorded and managed, fiscal risks are identified, and debts and guarantees are prudently planned, approved, and monitored34. This also covers contingent liabilities which are potential liabilities that may occur in the future, and how these can be backed up by resources.

47 The instruments that involve borrowing in the financial markets (see paragraph 45) generate contingent liabilities for the EU and the Member States. These liabilities are backed up differently, depending on the instrument. This can take the form of a budgetary guarantee (see Annex II), using the own resources ceiling headroom (see Figure 2), exceptionally increasing the own resources ceiling, or using paid-in capital and additional guarantees by the Member States. Figure 5 shows how contingent liabilities are backed up.

48 Loans for instruments not covered by the own resources ceiling which are financed in the markets (EFSF and ESM) have a percentage of amounts paid in capital, and the Member States provide additional guarantees to support the respective borrowing operations. In the case of the EFSF, the guarantees cover 165 % of the borrowed amounts. This over-guarantee was required to ensure the highest creditworthiness for funding instruments issued by the EFSF. For similar reasons, the ESM capital adds up to €704.8 billion (of which €80.5 billion is paid in and the remainder is callable capital), while its lending capacity is €500 billion. Following the accession of Croatia to the ESM in 2023, the ESM authorised capital will amount to €708.5 billion.

49 The instruments based on budgetary guarantees (InvestEU and EFSD+) are partially provisioned. The aim of this provision is to cover net expected losses and, in addition, provide an adequate safety buffer. As the EU budget (as limited by the MFF ceiling) is the ultimate coverage for defaults on these instruments, the provision aims to protect the EU budget from such possible defaults. Similarly, the loans to non-EU countries provided by the EURATOM or MFA are also partially provisioned and ultimately covered by the EU budget. The amounts set aside to provision the budgetary guarantees and the loans to non-EU countries are managed in a Common Provisioning Fund (see Annex II).

50 Loans for instruments covered by the own resources ceiling, providing support for Member States (the BoP and the EFSM), make direct use of ‘headroom’ (see paragraph 15) as an implicit guarantee to the markets that the funds will be repaid if the borrower defaults. The amounts concerned must therefore be carefully monitored to ensure that headroom is maintained at a level that does not interfere with the capacity to call upon the necessary amounts needed for the EU budget. Similarly, SURE may use the headroom from the own resources ceiling. In addition, all Member States were asked to provide an additional guarantee of €25 billion in total (25 % of SURE capacity).

51 There are notable differences in this respect. In the cases of the BoP and SURE, all Member States guarantee, via the own resources ceiling headroom, all amounts that have been lent to the beneficiary Member States. The case of the EFSM is different, as the EFSM regulation35 stipulates that when financial assistance is granted to a euro area Member State, the Member States that are not part of the euro area are fully compensated for any liability they may incur as a result of any failure by the beneficiary Member State to repay the financial assistance36.

52 This creates a difference in treatment between Member States for which we did not find any justification. Euro area Member States are liable to repay any assistance provided to non-euro area Member States (through the BoP), whereas non-euro area Member States are not liable to repay the assistance provided to euro area Member States (via the EFSM).

53 NextGenerationEU brought a new format for backing the way funding is obtained in the markets. A temporary increase in the own resources ceiling of 0.6 % made it possible to obtain the funds in the markets using a diversified funding strategy.

The EU’s financial landscape is only partly publicly accountable

The EU has introduced integrated reporting, but not all instruments are covered

54 Annual financial reports for all instruments should be prepared in a comprehensive and timely manner in order to support decision-making and appropriate scrutiny. These should be accompanied by a proper overview of the EU’s financial landscape as a whole37.

The Commission prepares several reports, but none of these includes an overview of all instruments of the EU’s financial landscape

55 In line with the Financial Regulation, the Commission prepares an integrated set of financial and accountability reports38, including the EU annual accounts. The EU annual accounts contain information on the instruments that are covered by the own resources ceiling. In addition, other reports required by the Financial Regulation contain additional information on those instruments (e.g. the report on financial instruments, budgetary guarantees, financial assistance and contingent liabilities39, or the 13 working documents annexed to the 2022 EU budget). Although these documents present specific aspects in detail, they do not provide an overview of all instruments of the EU’s financial landscape. The instruments not covered by the own resources ceiling are not included, namely the SRF, the EPF, the Modernisation Fund, the ESM, the EFSF and the GLF.

56 In 2021, the Commission prepared the Budgetary Transparency Report for the first time40, as a result of the inter-institutional agreement between the Commission, the European Parliament and the Council within the framework of the MFF41. The report includes information on some instruments that are not covered by the own resources ceiling (e.g. the EFSF and the ESM). The information provides a general overview of the instruments, aggregated by types and with links to sources of additional information on each of them. We note that the report does not cover the SRF, GLF, and EIB own operations. The European Peace Facility and Modernisation Fund were not active at the time the report was produced.

57 We noted that the instruments that are not mentioned in the EU’s annual accounts generally have regular financial reporting as required by the specific legislation that applies to each of them. The two exceptions are the European Peace Facility, for which the legal basis does not explicitly envisage any reporting to the general public or to the European Parliament (regular financial reporting should be made available only to the Council); and the GLF, for which the Commission prepares quarterly reports on the amounts owed by Greece and the Member States’ receivables. These are required in the inter-creditor agreement and are sent to the borrower and lenders for the purpose of calculating interest, but are not publicly available.

There is a gap in the audit of performance of those instruments not covered by ECA audit rights

58 The International Standards for Supreme Audit Institutions (i.e. the INTOSAI standards) call for all public financial operations, regardless of whether and how they are reflected in the national budgets, to be subject to audit by Supreme Audit Institutions42. In order to ensure full accountability and transparency, reliable and extensive external audit is essential43. The treaties establish the ECA as the external auditor of the EU44. Figure 6 shows the instruments for which the ECA has audit rights, and those for which it does not.

59 The ECA has audit rights for most of the instruments included in our analysis. Annex III summarises the external audit arrangements for those instruments not covered by ECA audit rights. The financial statements of the ESM, EFSF and EIB include the opinion of a private external auditor, to be prepared in line with International Standards on Auditing. As the European Peace Facility and the Modernisation Fund were set up only recently, the public external auditors have not yet produced an audit report. However, the arrangements envisage the financial statements being audited according to the ISA. In the case of the GLF, it is the lending Member States’ Supreme Audit Institutions that have audit rights.

60 In the past, we have highlighted the importance of the ECA having audit rights45, and have advocated that “public audit mandates should be established for all types of financing for EU policies” and that “the ECA should be invited to audit all bodies created through agreements outside the EU legal order to implement EU policies. This includes the ESM and the EIB’s non-EU budget-related operations”, further noting that “in some cases, a change in legislation may be required for establishing a public audit mandate”46. In our Opinion 2/1847, we also recommended that the ESM could grant the ECA a mandate to address the gap in the audit of performance we identified. In its reply to our Opinion, the ESM mentioned that “the current audit arrangements of ESM

61 Similarly, the European Parliament has called for greater ECA involvement in auditing these instruments. For example, it called upon the Council to amend Article 12 of Protocol 5 annexed to the TEU and the TFEU to give the ECA a role in auditing the EIB’s share capital48. Another example is the European Parliament resolution on the Commission’s proposal for the European Monetary Fund49, which concluded that in cases where EU budget resources are involved, the ECA should be considered the independent external auditor, and be given a clear and formal role in the discharge procedure50.

No democratic scrutiny by the European Parliament over the instruments not covered by the own resources ceiling

62 Public scrutiny is essential for the creation and oversight of the implementation of new instruments in order to ensure that those instruments are legitimate, justified and accountable51. This should apply to all instruments that engage public funds, even if outside the budgetary framework.

63 We found that the European Parliament has general oversight rights over the instruments covered by the own resources ceiling (see Figure 7). For some of these instruments, the European Parliament has limited oversight, meaning that although it is not responsible for a formal discharge procedure, it is informed of key decisions. For instruments that are not covered by the own resources ceiling (EIB own operations, the GLF, the ESM, the EFSF, the European Peace Facility and the Modernisation Fund), the European Parliament has no formal oversight rights, and democratic scrutiny can be exercised only by national parliaments. However, this creates a gap, since the nature or degree of public scrutiny – and hence of accountability – may vary according to the type of financing instrument used.

64 The accountability arrangements largely reflect the decision-making arrangement for creating a new instrument. In particular, the European Parliament was not consulted about the creation of some of the instruments because they were established by intergovernmental agreements rather than by an EU legal act (the EFSF, the ESM and the GLF).

65 In addition, the treaties do not require the European Parliament to participate in the creation of emergency-related instruments (the EFSM, SURE and NextGenerationEU)52. This was recognised and to some extent addressed in a 2020 joint declaration of the European Parliament, the Council and the Commission53, in which the three institutions agreed on and set up arrangements for a procedure of budgetary scrutiny between the European Parliament and the Council with the active assistance of the Commission. This procedure should be followed when the Commission presents a proposal for a new instrument with potentially appreciable implications for the EU budget. Under this procedure, the European Parliament and the Council would engage in constructive dialogue with a view to seeking a joint understanding of the budgetary implications of the legal act envisaged.

66 This agreement improved European Parliament scrutiny when new instruments are being created. However, for the reasons explained above, it is only based on a joint declaration and does not cover off-budget instruments, which have no implications for the budget.

The potential for simplifying the EU’s financial landscape has not been fully exploited

67 The EU budget should maintain a balanced level of flexibility in order to reduce the need for instruments to be created outside it, and it is good practice regularly to assess the possibility of consolidating the existing instruments54. In this section, we describe in greater detail the changes introduced to the EU’s financial landscape by the MFF 2021-2027. We also identify the areas where we believe there is room for further consolidation.

MFF 2021-2027: good progress has been made on streamlining the EU’s financial landscape

Increased flexibility of the EU budget and use of external assigned revenue

68 In order to establish whether there is an appropriate balance between predictability and flexibility, we examined the existing flexibility arrangements of the EU budget. These arrangements offset the limits resulting from the MFF ceiling because they allow a reserve to be set within existing limits in order to deal with particular and unpredictable needs (see Annex IV).

69 The scope and capacity of the flexibility arrangements have increased in the current MFF, and can reach a maximum of €21 billion in total55. Using these arrangements makes the EU budget more agile, and so allows it to respond to crises without the need to create dedicated instruments.

70 Another way to avoid creating new non-repayable instruments outside the EU budget is to use external assigned revenue. The advantage of such revenue is that it brings additional funds for EU action that the Commission implements according to the EU’s financial rules. Although this is an improvement over the use of off-budget instruments, external assigned revenue significantly alters the budget, as it comes on top of the amounts that were agreed by the Budgetary Authority in the framework of the annual budget negotiations. It also derogates from the budgetary principle of universality, according to which total revenue should cover all payments without any earmarking of expenditure56.

71 External assigned revenue deviates from the normal budgetary procedure, as such revenue is not included in the approved budget. However, both the source and destination of the funds are set out in specific legal acts, such as the NextGenerationEU regulation and basic acts establishing the expenditure programmes that benefit from it. Due to its specific nature, external assigned revenue is not included in the MFF expenditure headings57, and the amounts concerned are not ‘negotiated’ annually by the budgetary authority under the annual budget procedure. Nevertheless, the Commission prepares detailed estimates of assigned revenue every year58.

72 In the MFF 2021-2027, external assigned revenue will increase significantly. The overall amount of assigned revenue implemented in 2020 was €7.4 billion in commitments and €9.7 billion in payments. According to the Commission’s monthly reports on additional appropriations, in 2021 the amount jumped to €154 billion in commitments and €62.3 billion in payments. This increase mostly resulted from the NextGenerationEU instrument that was created to finance the EU’s economic recovery following the pandemic. The creation of the Innovation Fund59 and its consolidation in the EU budget is another example of external assigned revenue (see Box 4).

Consolidation of instruments and the effects of the COVID-19 crisis

73 To ensure continued justification for off-EU budget instruments, it is good practice to assess whether such instruments could be consolidated in order to simplify the overall financial landscape60 (see Figure 3).

74 The MFF 2021-2027 brought significant changes to the EU’s financial landscape. On the one hand, several instruments were consolidated, while, on the other, the response to the COVID-19 crisis required new ones.

75 As regards instruments relating to internal EU policies, InvestEU fund unified the investment instruments for operations inside the EU, bringing together 13 previously separate centrally managed financial instruments, and the EU budgetary guarantee formerly implemented under the European Fund for Strategic Investments (EFSI).

76 As regards external action, the overarching Global Europe Instrument (Neighbourhood, Development and International Cooperation Instrument, or NDICI) brought the majority of existing instruments and programmes together under one roof. With the NDICI, the Commission ‘budgetised’ the former EDF that had remained outside the EU budget for 50 years (see Box 5). The EFSD+, also operating under the NDICI, brought together the EU budgetary guarantee for external actions, the former EIB External Lending Mandate, regional blending facilities, and reflows of money from the former ACP Investment Facility.

“Budgetisation” of the EDF: an achievement 50 years overdue

From 1959 until 2020, the EDF financed EU development cooperation with the African, Caribbean and Pacific (ACP) Group of States and Overseas Countries and Territories. The EDF existed independently of the EU budget and the MFF, and was funded by negotiated Member State contributions.

Both the Commission and the European Parliament had called for the EDF to be integrated into the general budget since 1970s but the Council did not approve the proposal. The European Parliament adopted several resolutions61 and the Commission prepared a number of communications62, but the Council never reached a consensus that would allow the EDF to be brought into the EU budget.

After 50 years of unsuccessful attempts, the Member States agreed in the Council that the ACP-EU partnership, which had previously been financed through the EDF, would be financed by the EU budget from 1 January 2021 onwards. The actions that had previously been financed by the EDF were included in the new NDICI-Global Europe and other instruments. The EDF global commitments concluded before 31 December 2020 will, however, continue to be implemented until at least 2045 according to Commission estimates, so the old EDF and the new NDICI systems will temporarily exist in parallel.

77 Two other instruments were also terminated: the Facility for Refugees in Turkey and four EU Emergency Trust Funds (Africa, Bêkou, Colombia and Madad). Instead, the support provided by those instruments was replaced by the NDICI-Global Europe programme within the EU budget, which was provided with methods expected to respond better to needs that can emerge.

78 In addition, two former off-budget defence-oriented instruments – the African Peace Facility and the Athena mechanism – were merged into the European Peace Facility, thus bringing all EU expenditure with military implications under one instrument.

79 Despite efforts to consolidate the EU’s financial landscape, the response to the COVID-19 crisis led to the creation of two new instruments, SURE and NextGenerationEU. We note, however, that unlike some previous crisis-response mechanisms (e.g. the GLF, the EFSF or the ESM), SURE and NextGenerationEU were established under the own resources decision (using a temporary additional ceiling), and so allowed for more transparent public scrutiny.

A complex assortment of financial assistance instruments

80 As Figure 3 shows, there are currently eight financial assistance instruments: the GLF, the EFSF, the ESM, the EFSM, the BoP, SURE, the MFA and EURATOM loans. Although they were designed to respond to different needs, overall these instruments are similar, as they all use borrowed money (except the GLF) to provide financial assistance to Member States63 and some non-EU countries64. The following paragraphs present the results of our analysis of the options for consolidating these financial assistance instruments.

Unsuccessful attempts to reform or update some of these instruments

81 We looked into the Commission’s previous proposals to reform financial assistance instruments, and describe below how such attempts were unsuccessful.

82 In 2012, the Commission presented a proposal to update the BoP65. The main objectives of the proposal were to introduce new precautionary instruments, and to make the decision-making process more efficient by reducing the number of procedural steps. The proposal was not approved by the Council.

83 The lack of a framework regulation (see paragraph 40) was identified as limiting the effectiveness of the MFA instrument, as decisions are taken on a case-by-case basis. To address this limitation, the Commission presented a proposal, but then had to withdraw it because the European Parliament’s views conflicted with those of the Council (see Box 6).

Macro-Financial Assistance: The framework regulation conflict

In 2011, the Commission presented a proposal66 for a framework regulation for financial assistance to non-EU countries. The proposal aimed to provide a general set of rules for granting financial assistance that, at the same time, would speed up the process and provide a legal basis for the largely informal agreements that had guided it until then.

The proposal was amended by both the European Parliament and the Council, and introduced the requirement to keep the ordinary legislative procedure for each individual Macro-Financial Assistance operation. The Commission considered that this changed the objectives of the proposal, and withdrew it in 2013.

In August 2013, the European Parliament and the Council adopted a Joint Declaration,67 which was a compromise between the two co-legislators, and aimed to speed up the approval process. However, it was a political agreement that was not legally binding: MFA decisions continue to be taken under the ordinary legislative procedure on a case-by-case basis.

Recent evaluations68 highlight that the lengthy process for approving MFA decisions makes the instrument less effective, and suggest that a framework regulation could address this limitation.

84 The EFSM was created as a temporary solution to address the 2010 financial crisis. However, this ‘temporary’ solution has now existed for more than 10 years. The Commission indicates that the EFSM should not be used; but it can still be reactivated69.

Several stakeholders have called for the ESM and EFSF to be incorporated into the ‘EU legal framework’

85 We analysed the different positions taken by the key stakeholders regarding the existing financial assistance instruments, paying particular attention to their suggestions to consolidate them further.

86 In previous years, several stakeholders have suggested that the ESM should be integrated into the ‘EU legal framework’. The Commission presented a proposal to create the European Monetary Fund, which would transform the ESM and include it in the ‘EU legal framework’. We have welcomed70 the Commission’s proposal, and the European Central Bank has also published a favourable opinion71. However, the Council did not approve the proposal (see Box 7).

The five presidents’ report72 and the Commission’s proposal to create a European Monetary Fund, replacing the ESM

The five presidents’ report notes that “the European Stability Mechanism has established itself as a central instrument to manage potential crises. However, largely as a result of its intergovernmental structure, its governance and decision-making processes are complex and lengthy. In the medium term, its governance should therefore be fully integrated within the EU Treaties”.

Based on these conclusions, in 2017 the Commission presented a proposal73 to build on the well-established structure of the ESM and create a European Monetary Fund anchored within the ‘EU legal framework’*. The Commission proposal would, in practice, transform the current ESM into an EU body74 based on the provisions of Article 352 TFEU.

* Different terminology was used by the various stakeholders when suggesting the integration of the ESM, such as ‘the EU legal framework’, ‘the EU framework’, ‘the EU regulatory framework’, ‘the EU acquis’, ‘the EU legal order’ or ‘the EU treaties’.

87 The European Parliament has previously called for the ESM to be integrated into the body of common rights and obligations that are binding on all EU Member States (the acquis75) or EU law76, and the ESM also supports the long-term objective of being integrated into the ‘EU framework’ while preserving the key features of its governance. This was expressed by former Eurogroup President and Chair of the ESM Board of Governors in a letter to the then Council President of 25 June 201877. Our work confirmed that these positions are still valid.

88 The EFSF was created with very limited activity time (no new programmes or agreements could be established after 30 June 2013)78, and its framework agreement acknowledges the possibility of integrating it into the ESM79. The ESM Treaty also contains enabling clauses80 to allow the EFSF to be integrated into the ESM. The new ESM Treaty currently under ratification further simplifies these clauses in order to allow for the integration of the EFSF81. However, despite these clauses, the EFSF has not yet been integrated into the ESM.

Financial assistance instruments are not yet consolidated

89 We examined whether it is justified to keep all existing financial assistance separate, or if there is room for consolidation.

90 Most of these instruments were created in response to an emergency, and the GLF, EFSF, EFSM and SURE were explicitly established as interim or temporary solutions. Neither the GLF nor the EFSF is active anymore, but their assets are still held and managed separately from the other instruments. Although all eight financial assistance instruments were justified when they were created, they are not yet consolidated.

91 In its proposal for the creation of a European Monetary Fund, the Commission also expressed the need for consolidation: “A stronger Economic and Monetary Union requires stronger governance and a more efficient use of available resources. The current system still reflects a patchwork of decisions taken to face an unprecedented crisis. This has sometimes led to a multiplication of instruments and an increased sophistication of rules, which is a source of complexity and creates risks of duplications. Greater synergies, streamlined procedures and integration of intergovernmental arrangements within the EU legal framework would strengthen governance and decision-making”82.

92 The need for consolidation and thorough review of all these financial instruments was confirmed by the COVID-19 crisis. Although the ESM created a specific COVID-19-related credit line to provide quick assistance to euro area Member States, it was not actually used. However, SURE was created in an emergency, and the related loans were used by 19 Member States.

Conclusions and recommendations

93 We conclude that, even if there were reasons for creating new types of instruments, the piecemeal approach taken to set up the EU’s financial landscape has resulted in a patchwork construction of instruments with different sources of finance and governance arrangements.

94 We found that new instruments were created to respond to emerging policy challenges and to legal or practical constraints on using existing instruments. However, most of the instruments we assessed (10 out of 16), including those not proposed by the Commission, did not follow good practice by including clear evidence that the option selected and its design were the most suitable (see paragraphs 34 to 36). As a result, the governance arrangements of similar types of instrument vary substantially, thus increasing overall complexity (see paragraphs 39 to 43).

Recommendation 1 – Ensure adequate prior assessment of the design and options for all new instruments

The Commission should:

- within the existing framework, ensure that any new instrument it proposes contains an assessment of the design chosen and the need to create that instrument inside or outside the EU budget, and

- share this good practice with the Council with a view to applying it to new instruments not proposed by the Commission.

Target implementation date: 2024

95 We also found that not all instruments have adequate public accountability arrangements. Despite improvements in reporting, consolidated information on all the instruments is lacking. Although the recently introduced Budgetary Transparency Report is a positive step, it does not cover all instruments (see paragraphs 55 and 56).

Recommendation 2 – Compile and publish information on the EU’s overall financial landscape

The Commission should compile and publish information on all instruments of the EU’s overall financial landscape.

Target implementation date: 2024

96 In addition, we identified a gap in the audit of performance of those instruments not covered by ECA audit rights (see paragraphs 59 to 61), as well as a lack of provisions for European Parliament scrutiny of instruments not covered by the own resources ceiling (see paragraphs 62 and 63). We have suggested in previous publications that, “public audit mandates should be established for all types of financing for EU policies” and that “the ECA should be invited to audit all bodies created through agreements outside the EU legal order to implement EU policies. This includes the European Stability Mechanism and the European Investment Bank’s non-EU budget-related operations”, further noting that “in some cases, a change in legislation may be required for establishing a public audit mandate”. We also recommended that the ESM could grant the ECA a mandate to address the gap in the audit of performance we identified. We now reiterate these suggestions. Similarly, the European Parliament and the institutions concerned could draw up an agreement to allow scrutiny by the European Parliament, as a complement to existing scrutiny from national parliaments.

97 The Modernisation Fund was created outside the EU Budget, unlike the Innovation Fund (see paragraph 43). This led to different governance arrangements, no oversight by the European Parliament, and no audit rights for the ECA (see paragraphs 43, 59 to 61 and 63).

98 Although we acknowledge the recent progress made on consolidating several types of instruments into the EU budget, the potential for simplification has not yet been fully exploited. We found that the MFF 2021-2027 yielded good progress in terms of consolidating the EU’s financial landscape, in particular by integrating the actions that had previously been financed by the European Development Fund into the EU budget. The EU also consolidated a number of EU budget investment instruments under InvestEU and the Neighbourhood, Development and International Cooperation Instrument (including the European Fund for Sustainable Development plus (see paragraphs 73 to 79). However, we believe that there is still scope to consolidate the Modernisation Fund into the EU budget.

Recommendation 3 – Propose to integrate the Modernisation Fund into the EU budget

The Commission should propose the integration of the Modernisation Fund into the EU Budget for the next Multiannual Financial Framework, taking into account the specificities of the Fund.

Target implementation date: 2025

99 As regards financial assistance instruments, we found scope for streamlining the current arrangements, which are complex (see paragraphs 80 to 88), and unjustified different treatments (see paragraph 52). In some cases, we found that the Commission had identified limitations in the current arrangements, such as the Macro Financial Assistance instrument and the Balance of Payments facility, and proposed solutions that were not taken up by legislators (see paragraphs 82 and 83). In particular, the Commission has recognised that keeping the European Stability Mechanism outside the ‘EU legal framework’ weakens governance and decision-making (see paragraph 91). Several stakeholders have called for the European Stability Mechanism (and the European Financial Stability Facility) to be incorporated into the ‘EU legal framework’ (see paragraphs 85 to 91), including the presidents of the Commission, the Council, the European Central Bank, the European Parliament and the Eurogroup. The former Eurogroup president and Chair of the European Stability Mechanism Board of Governors also shared this view of integration (see paragraph 87). In this context, we note that the European Stability Mechanism’s COVID-related credit lines were not actually used by Member States, contrary to other crisis-response mechanisms created by the Commission, such as the European instrument for temporary Support to mitigate Unemployment Risks in an Emergency (SURE) and NextGenerationEU (see paragraph 92).

Recommendation 4 – Propose the integration and consolidation of existing financial assistance instruments

The Commission should:

- engage with the European Parliament, the Council and the European Stability Mechanism with a view to reaching a common position on the integration of the European Stability Mechanism into the ‘EU legal framework’;

- present new legislative proposals with a view to consolidating existing financial assistance instruments.

Target implementation date: 2025

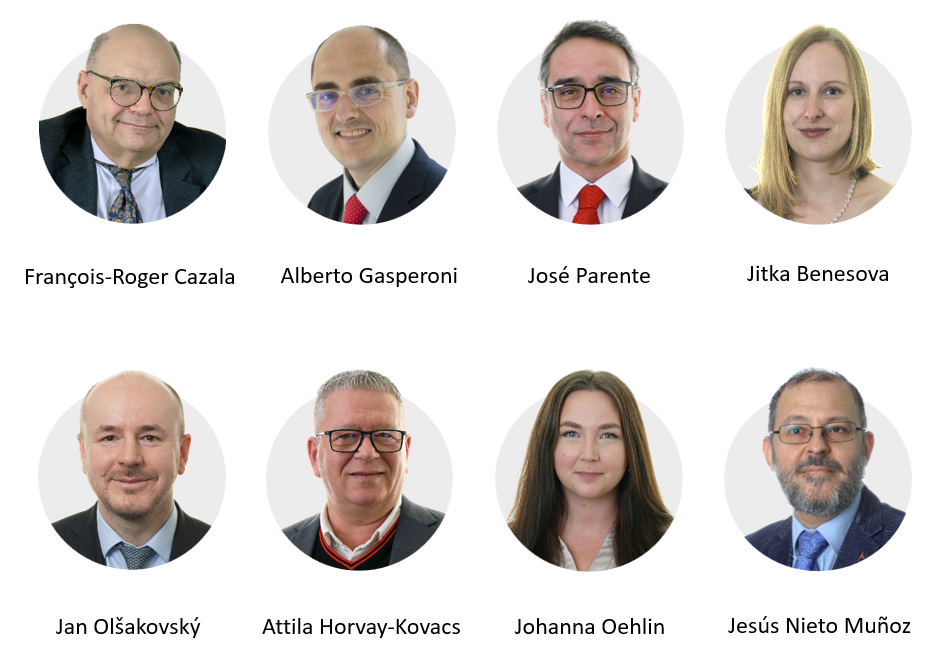

This Report was adopted by Chamber V, headed by Mr Jan Gregor, Member of the Court of Auditors, in Luxembourg on 17 January 2023.

For the Court of Auditors

Tony Murphy

President

Annexes

Annex I – Size and capacity of the instruments we analysed

| Instrument | Size / Capacity |

|---|---|

| Balance of Payment assistance programmes for Member States outside the euro area (BoP) | €50 billion capacity. Usage at 31 December 2021: €200 million. |

| European Fund for Sustainable Development plus (EFSD+) | No amounts pre-determined. However, according to Commission internal calculations, there is a pre-allocated capacity from the External Action Guarantee that allows €41 billion for the EFSD+ instrument. |

| European Financial Stability Facility (EFSF) | €440 billion capacity. Usage at 31 December 2021: €194 billion. * This instrument is not currently active. No more amounts can be used. |

| European Financial Stabilisation Mechanism for Member States inside the euro area (EFSM) | €60 billion capacity. Usage at 31 December 2021: €46.8 billion. |

| European Investment Bank (EIB) own operations | €249 billion of subscribed capital. Capacity is not defined. Outstanding loans disbursed at 31 December 2021: €433.4 billion. |

| European Peace Facility (EPF) | €5 billion to be used in the 2021-2027 period. |

| European Stability Mechanism (ESM) | €500 billion capacity. Usage at 31 December 2021: €89.9 billion. |

| EURATOM loans | €4 billion of general capacity. Usage at 31 December 2021: €350 million, including €300 million for non-EU countries. |

| Greek Loan Facility (GLF) | €80 billion capacity. Usage at 31 December 2021: €52.9 billion. * This instrument is not currently active. No more amounts can be used. |

| Innovation Fund (IF) | It is estimated that around €38billion of support will be provided from 2020-2030, depending on the carbon price. |

| InvestEU programme | €26.2 billion capacity. |

| Modernisation Fund (MF) | It is estimated that around €51 billion of support will be provided from 2020-2030, depending on the carbon price. |

| Macro-Financial Assistance (MFA) | No amounts pre-determined. However, according to Commission internal calculations, there is a pre-allocated capacity from the External Action Guarantee that allows €11.6 billion for the MFA instrument. Usage at 31 December 2021: €7.4 billion. |

| NextGenerationEU - EU Recovery Instrument and programmes financed from NextGenerationEU | Capacity: 750 billion euros, of which €360 billion in the form of loans and €390 billion in grants. |

| Single Resolution Fund (SRF) | 1 % of covered deposits of all credit institutions authorised in all the participating Member States (estimated to be around €80 billion). As of July 2022, the SRF stands at approximately €66 billion. |

| European instrument for temporary Support to mitigate Unemployment Risks in an Emergency (SURE) | Capacity: €100 billion. Usage at 31 December 2021: €91.1 billion. |

Annex II – Contingent liabilities and the Common Provisioning Fund

The EU budgetary framework contains three main sources of contingent liabilities:

- Budgetary guarantees – guarantees provided to the implementing partners (the most significant being the EIB Group). For the MFF 2021-2027, these guarantees were aggregated under two main umbrellas: InvestEU and the EFSD+. There are also legacy budgetary guarantees from previous MFFs that cover the EFSI, the EFSD and the External Lending Mandate. Under all these instruments, the EU provides guarantees for losses in the guaranteed financing and investment operations by implementing partners;

- Financial assistance to non-EU countries – for the MFF 2021-2027, these apply to MFA and EURATOM loans. In these cases, each loan is funded by a corresponding EU bond, which fully matches the EU loan. For the EU, the liability is contingent, since no EU resources are needed to settle the EU debt unless the beneficiary country defaults;

- Financial assistance to EU Member States – as in the cases of the BoP, the EFSM, SURE and legacy EURATOM loans to Member States. These are similar to financial assistance to non-EU countries, but the loans are granted to EU Member States.

Contingent liabilities stemming from financial assistance to EU Member States are not provisioned. Therefore, if a Member State defaults on a repayment, the EU should draw the necessary amounts from the other Member States, using the headroom between the MFF ceiling and the own resources ceiling.

By contrast, contingent liabilities arising from budgetary guarantees and from financial assistance to non-EU countries are partially provisioned. This provision aims to cover the expected losses, and includes a margin for unexpected losses (the provision rate varies between 9 % and 50 %, depending on the instrument). This provision protects the EU budget from defaults, but requires the money to be ‘parked’ in a fund.

In the past, the amounts set aside to provision budgetary guarantees were managed separately (each guarantee fund had separate management), and in some cases were delegated to the implementing partners (e.g. the EIB Group). However, the changes introduced by Article 212 of the Financial Regulation required the provisions made to cover financial liabilities arising from financial instruments, budgetary guarantees or financial assistance to be held in a Common Provisioning Fund (CPF). For the MFF 2021-2027, the Commission has decided to establish the CPF, which so far includes provisions for all budgetary guarantees and financial assistance to non-EU countries, and is managed centrally by the Commission. At the end of 2021, €12.3 billion of assets were under CPF management.

The Commission views the creation of the CPF, and the management of the respective assets being transferred to the Commission, as an important step towards consolidating the EU’s financial landscape, as it brings together several similar instruments (guarantee funds), existing across different policies and programmes, under a single umbrella.

Annex III – Instruments for which the ECA does not have explicit audit rights

| Instruments | Summary of external audit arrangements |

|---|---|

| EFSF | The EFSF has an Audit Committee. It assists the Board of Directors in discharging its responsibilities in financial reporting, internal control, risk management, internal audit, and external audit of the EFSF. The Audit Committee consists of five members who are appointed by the Board of Directors from among their number, for a renewable term of office of one year. A private audit firm carries out external audit and public audit reports are published, together with the Financial Statements, as required by Luxembourg law. |

| ESM | The ESM’s accounts are audited by independent external auditors, who are approved by the ESM Board of Governors and are responsible for certifying the annual financial statements. The ESM has a Board of Auditors, which is an independent oversight body for the ESM. The Board of Auditors inspects the ESM’s accounts, and verifies that the operational accounts and the balance sheet are in order. Under its mandate, it audits the regularity, compliance, performance, and risk management of the ESM, and monitors the ESM’s internal and external audit processes and their results. The Board of Auditors produces a report in respect of the financial statements addressed to the Board of Governors. The Board of Auditors consists of five members appointed by the Board of Governors. It includes two members from the Supreme Audit Institutions of the ESM’s Members, and one from the European Court of Auditors. A private audit firm carries out external audit and public audit reports are published together with the Financial Statements, as required by the ESM Treaty. |